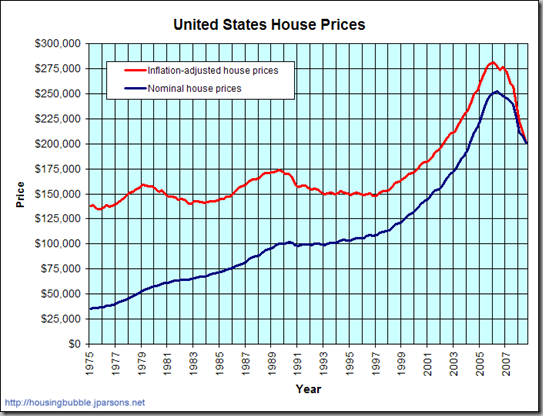

I've been doing a little research on historic real estate price trends. I don't think that many people realize how much appreciation we really had in home prices from 1998 to 2006 - it was an amazing run! Even with the bottom dropping out of the market, we're still above the 30 year "average trend line":

But as history has shown, real estate prices are cyclical. Just like the tech stock crash in 2001, the faster the run-up in prices, the further things fall. Most people who've owned their homes for ten years without re-financing are still sitting on very good equity - and even their "annualized" return is probably pretty good at today's prices. These folks are in good shape, even if they're kicking themselves because of the value they've lost in the last year.

The people who are in trouble are the folks that re-financed to take out cash, drew money out of home equity loans, or bought a home at the top of the market with a higher than 80% loan to value mortgage. A good portion of these homeowners are now underwater.

I've said this before in another posting, but it bears repeating: the root cause of all our current economic problems is too much debt. One mortgage that's underwater wipes out the profits for hundreds of "good" mortgages, which is why the banks are in so much trouble. Yes, "credit default swaps" and other complex financial instruments were idiotic and definitely made things worse. And yes, the highest percentage of the problem mortgages were in the "sub-prime" category - but certainly not all of them. There's plenty of blame to go around. But I maintain that the banking industry is in trouble primarily because the traditional 20% down payment rules went out the window.

Where do we go from here? During the Great Depression, home values continued to slowly fall for almost 13 years! Ouch! Yes, it can happen again. Depending on how you read the charts, home values are still anywhere from 3 to 10% above the historic "average trend line" - and there's nothing saying we won't go below the trend line for a while. Can we withstand an additional drop in home values, say ... another 20%? now that's a hard pill to swallow. Personally, I don't think that will happen, but I don't think we've seen the bottom quite yet.

On that note - I'm in agreement with everyone who has said that 2008 pretty much sucked (sorry for having to use technical terminology - just don't know quite how else to say it!) - I'm hoping for a better 2009. Happy New Year's to all!