There was a report a few weeks ago talking about the inflation in Zimbabwe. The "Official" rate of inflation is 230 MILLION PERCENT, while some analysts put the number in the billions. The full story is here:

http://edition.cnn.com/2008/WORLD/africa/11/03/zimbabwe.money/index.html

They can't seem to print money fast enough to keep up. Previously, the largest bill was 50,000 Zimbabwe dollars, and now the new bill is Z$1,000,000, and they're still expecting currency shortages!

I remember when South American countries were all in an economic free-fall back in the 90's. If you ate at a restaurant in Argentina, you needed to pay for your meal when you ordered, because if you waited until after you finished, the price will have doubled. And that's with an inflation rate of "only" a few thousand percent.

How in the heck do you keep things "synchronized" from store to store with a 230 million percent inflation rate? It's ludicrous!

Of course, this leads to the question of how stable the U.S. dollar is. Are we headed for increased inflation and devaluation of the dollar? You betcha we are, no doubt about it. Probably not at the "hyper-inflation" levels we're talking about, but inflation is still inflation. It diminishes the value of any "cash based" assets, reduces earning power, and makes imported goods more expensive compared to domestic goods.

Here's the problem. As the world's economies are all intertwined, all major currencies can fluctuate at the same time - and in the same direction. So it's possible to have a situation where you don't have a big change in import prices, and exchange rates won't vary noticeably, but everyone could still feel the diminishing value of cash based assets.

Which begs the question, what is a stable benchmark to use? Gold? Gold based currencies?

While it's true that gold does have an "intrinsic" value, it is also subject to supply and demand - and emotion. But yes, if the "value" of gold stays the same and currencies sink, then the "price" of gold appears to go up. Gold based currencies do tend to be more stable, but (as we've seen) they can be mis-managed as well.

How about the "labor" based benchmarks? The theory is that rather than saying that the price of goods and labor has gone up, you assume that the value of labor is fixed but the price of goods, and currency, changes. Put it this way: will a days work will buy you and your family enough to eat and enough to live in a house, and if times are good then maybe you'll have enough left over to buy some non-essential items or take a vacation? It doesn't matter if the average exchange rate of labor for currency is one hour per dollar or .02 hours per dollar (or as you're used to seeing it stated: $50 dollars per hour).

The problem with this benchmark is that it used to be that a family with a single wage earner could get by just fine. Now, everyone struggles to survive with two wage earners in a household. The root cause of this change is that technology has improved the effectiveness of labor - for the most part, labor is more efficient, so less of it is required. This manifests as less hours per acre of corn grown and less people needed to build a car. This steers more people towards office and professional work. I'm fanatical about efficiency and reduced waste, so I see this as a good change - but it invalidates the notion of using labor as a currency benchmark, as some economists still promote.

What's the old saying? The only thing that's consistent is change. Something like that. I guess this applies to currencies as well as everything else.

12/7/08 update:

Less than two weeks later, they have gone from printing a Z$1 million bill, to a Z$200 million bill. In this time, the price of a loaf of bread has gone from Z$2 million to Z$35 million! Yikes! See the story here:

http://edition.cnn.com/2008/WORLD/africa/12/06/zimbabwe.currency/index.html

12/19/2008 update:

Exactly a month from when I wrote the initial post above, the Zimbabwe government has discontinued the Z$1,000,000 bill and the Z$200,000,000 bills, in favor of the the all new Z$10,000,000,000 (that TEN BILLION dollars) - that's 10,000% increase in one month. And that's AFTER slashing ten zeros from the currency in August (basically doing a 10,000,000,000 to 1 devaluation of their dollar already this year!)

http://edition.cnn.com/2008/WORLD/africa/12/19/zimbawe.currency/index.html;

1/10/09 update:

Now it's getting ridiculous. The Zimbabwe government announced it is now circulating the all new - get this - $50,000,000,000 bill. That's 50 BILLION dollars, if you're having trouble counting that many zeros! The official exchange rate is now pegged at 25 billion to one US$, so the new note is worth about two bucks. At the same time, unemployment has hit 80%:

http://edition.cnn.com/2009/WORLD/africa/01/10/zimbawe.currency/index.html

1/16/09 update:

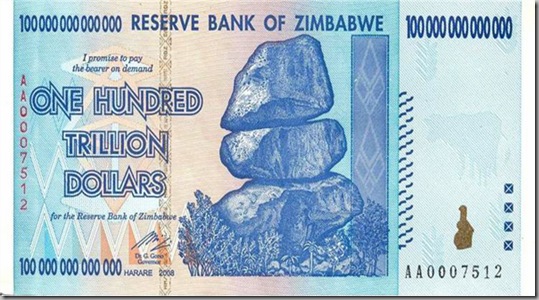

I can't even keep up with this story! Only six days since my last update - the Zimbabwe 50 billion dollar is out. The new series of notes? 10, 20, 50, and 100 TRILLION dollars! Seems like the only good business in Zimbabwe is to be a paper supplier to the treasury. Here's the official story:

http://edition.cnn.com/2009/WORLD/africa/01/16/zimbawe.currency/index.html

2/1/09 update:

It was bound to happen. The Zimbabwe government has slashed 12 zeros from the currency, effectively doing a trillion to one devaluation of the currency. The inflation continues to run rampant, however, so I'm sure they will be adding more zeros back onto the bill soon enough! Obviously, it would be prudent for them to just drop their local currency completely and just use U.S. dollars or the Euro:

http://edition.cnn.com/2009/WORLD/africa/02/02/zimbabwe.dollars/index.html

6/20/09 update:

I just ran across an interesting article. The Cato Institute has calculated that the Zimbabwe Dollar actually hit an inflation rate of 89.7 Sextillion Percent!:

http://www.cato.org/zimbabwe

Here is the last note they printed before the “Trillion to one” devaluation of the Zimbabwe dollar: