Back in 1973, two mathematicians named Fischer Black and Myron Scholes wrote a paper entitled "The Pricing of Options and Corporate Liabilities". This became known as the “Black-Scholes option pricing model”, which earned them a coveted Nobel Prize in economics in 1997 (technically, Myron Scholes shared the prize with Robert Merton, another collaborator, since Fischer Black had passed away by that time).

The Black-Scholes option model serves as the benchmark for setting the price of a common stock option. All you need to know is the stock price, the strike price of the option, the time left to expiration, the current interest rate, and this tricky little thing called the volatility of the stock.

Ahhh, the volatility. There’s the rub. The volatility of a stock is calculated using an iterative process called a “cumulative normalized distribution function”. Basically, it looks at the variations of a stock’s up and down movement over a certain time period and offers up a percentage of the average movement. The volatility is an absolute measurement, which is different from a stock’s “beta” – the beta is a ratio of that particular stocks’ volatility as compared to the rest of the market, which is actually much easier to measure.

In my definition of volatility, I said that it relies on the variation of a stock price over a certain period of time. But what period of time should you use? One week? A month? Three months? Six months? A year? Maybe two years? The time period that you use can make a huge difference in the value of the option, but there’s no general recommendation for what period to use.

All of the other factors (stock price, strike price, time to expiration, etc.) are quantifiable values that can be specifically defined. The volatility, however, requires a bit of artistic interpretation. If the stock was highly volatile nine months ago, but is more stable now, then measuring the historic volatility over the last six months is probably a good choice. Or not.

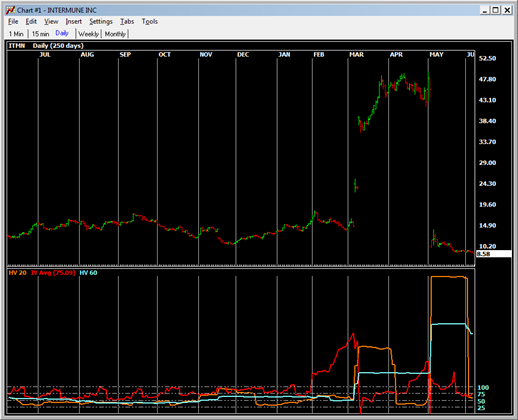

The chart below shows the stock price for Intermune (Symbol: ITMN), a small biotech company. In early March of 2010, an FDA review panel said that they would recommend approval for Intermune’s new drug and the price soared from around $15 per share up to the high $40’s. The FDA chose to ignore the recommendation of the review panel, and they decided not to grant approval in the first week of May, asking instead for additional information, which drove the price back down to under $10 per share:

Below the stock chart, you see another graph with three lines – the orange line is the volatility over the previous 30 days (one month) and the blue line is the volatility over the previous 60 days (two months). Anyone looking at the stock chart would agree that the stock was highly volatile throughout March, April, and May – but the “30 Day” measurement (orange line) shows that the volatility dropped down below 50% during most of April, as there wasn’t that big of a movement in the stock price over the 30 day window from about April 5 through the end of the month.

In contrast, the 60 day line (in blue) shows a more representative picture, as the period of high volatility lasted for almost exactly 60 days.

Note that the scale of the bottom graph tops out at 100%, which is normally considered a “high” volatility ... but both lines go up well over 100%, with the 30 day (orange line) volatility hitting a whopping 400% or so during May!

The red line shows the most interesting aspect of the Black-Scholes model: the “Implied Volatility”. This is a fascinating subject, and discovering all the nuances of the Implied Volatility has been a passion of mine for quite a few years now. Look at it this way: let’s say the Black-Scholes model says that an option should be worth $2.25 per contract, using a historic volatility of .55 for example (or 55%), but the option is really selling for $4.00 per contract. You can plug all the numbers into the formula backwards, and instead of solving for the price, you start with the price and solve for the volatility.

Suddenly you find that although the “historic volatility” of the stock is 55%, the current price suggests that the “implied volatility” is 90%. This means that the market thinks that the volatility in the future will be higher than it has been in the past. The market price is “implying” a higher volatility.

Again, there is no “time period” for calculating the Implied Volatility – but unlike using the historic volatility, you have an advantage. You can use different forward looking expiration dates to see when the market thinks the volatility will increase. So if you have options expiring in three weeks and again in seven weeks, you can see if the Implied Volatility is different between the two – which can give you an idea of the time period of expected increase in volatility.

In the above chart, the red line shows the implied volatility of the “near term” options. Note that leading up to the first week in March, the price of the stock is stable and the historic volatility is relatively low – but the price of the options went up steadily throughout the entire month of February. This is because the market anticipated the upcoming announcement – but no one was sure if the news was going to be good or bad. Again, in the month of April, as the 30 day historic volatility line went down, the implied volatility climbed back up as investors were looking forward to the final ‘yeah or nay’ vote from the FDA.

Is this just an academic exercise? Certainly not! If a small pharmaceutical company has an upcoming decision by the FDA announcing whether their drug will be approved or not, or a small defense contractor is waiting for word of a large military order that will either make or break the company, then the implied volatility will almost always go up. Sometimes waaaaaaaay up. There is no other “traditional” technical indicator that can give you a heads up as to an upcoming move in a company’s stock price when it is up against a “binary event” like this.

So what is the “dirty little secret” of the Black-Scholes formula? Well, I’m not going to tell you.

Ok, I’ll spill the beans: the volatility and the implied volatility will almost always move in exact opposite directions from the calculations around the “Binary Event” date. The Black-Scholes pricing model completely falls apart in this situation ... before the event, the historic volatility is low, and the Black-Scholes analysis (using the historic volatility) will say that that the option should be priced low – but as the market is anticipating a large movement in the price of the underlying security, the price of the option goes up (as measured by the “implied volatility”). Conversely, after there is a big change in the stock price and the historic volatility is very high, which would normally indicate a high price for the option going forward, the option price is low because the market does not foresee another big change in the near future.

What’s the bottom line? What can an investor do with this information?

It’s a bit tricky. An astute options investor can monitor the Implied Volatility of all the stocks in the market and get a very good indication when a particular stock is going to have a big move in the near future – but there is no indication what direction the move will be. In a highly liquid market like we have with U.S. securities, the stock price itself would move if there was a reliable consensus of whether the news was going to be good or bad.

Buying or shorting the stock itself is not a viable strategy, since you don’t know what direction the stock will move and the odds are it will move quite far, so potential losses may be substantial.

In a “perfect market” the analysts following the company would project the potential high and low price of the stock after the news is announced (depending on whether the news was good or bad), and the stock would float almost perfectly in the middle of that range until the news was announced ... and the price of the “at the money” options would be one half of the expected move; meaning that the cost of an option straddle is expected to be the same as the anticipated movement of the stock. So if the stock was $50 per share, and the analysts expect the stock to move to either $35 or $65 (a $15 move in either direction) after the news is announced, the “at the money” options would most likely be priced at around $7.50 each for both calls and puts.

This makes it difficult to use standard option strategies in this situation. Buying or selling straddles, covered calls/puts, or traditional spreads will almost always be unprofitable.

However, there are some multi-leg option strategies that can capitalize on the movement in one direction and minimize losses in the other direction. These trades are very complicated, and take a deep understanding of option dynamics – but they can be profitable if properly executed. You can also look at more obscure data like the “Volatility Smile”, the volume of calls vs. puts, or the ratio of ‘in the money’ vs. ‘out of the money’ option volume to try to glean some indication of what direction the other option traders think the stock will move.

The Black-Scholes pricing model is an amazing benchmark, used all over the world – but tread carefully if you find a situation where the historic volatility of a stock is fairly steady, but the option price (i.e., Implied Volatility) is rising dramatically. You can get in over your head quite easily.