Everyone knows that our national debt is completely out of control. But there’s an important issue that the press seems to be ignoring: the potentially devastating effect of rising interest rates.

The Federal Reserve is responsible for implementing our fiscal policy, but the Fed can not “set” interest rates – the overall market does that, based on supply and demand. However, the Fed can influence rates by increasing or restricting money supply. At the moment, just like in Louisiana and Mississippi, the floodgates are wide open. The bond market is awash in “virtually free” money, which is artificially keeping interest rates at historic lows.

But here’s the crux of the issue: with the floodgates open, the reservoir will eventually run dry – and the expectation is that interest rates will then rise. What happens to our federal budget when rates go up? It could get really ugly really quickly.

Here’s why:

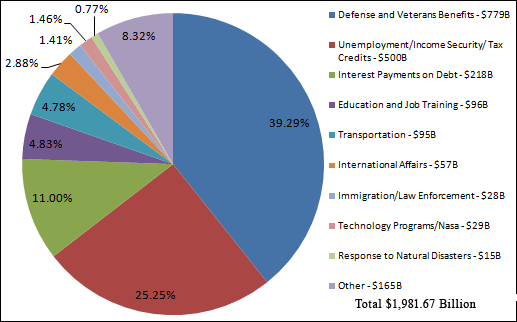

If you look at the chart in my earlier post, Trying to Make Sense of the Federal Budget, (the second chart, with the Social Security and Medicare numbers removed), you will see that interest payments on the federal debt clocked in at $218 billion in 2010, or 11% of our federal budget:

The weighted average interest rate of all the US debt currently runs about 2.07%. Shorter term debt has a lower interest rate – less than .25% – and longer term debt has a higher interest rate – approaching 4.375%. When longer term debt is more expensive than short term debt, we have what is referred to as a “rising yield curve”, which is actually normal. Investors want to be compensated for committing to a longer term note. So far so good.

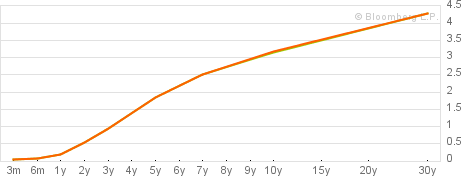

Here is the yield curve on government treasuries, as of today:

The problem is that too big of a disparity between short term and long term rates really indicates that the market expects all rates to rise in the future.

Usually, the difference between short term and long term rates is nominal, one or two percent at most. The slope of the current yield curve is not outrageous – but worrisome. It means that investors (buyers of government bills, notes, and bonds) don’t want to get “locked in” to low interest rates for the long term, since the “future value” of the bonds will go down if interest rates rise (as you always hear in news reports, the value of bonds move in the opposite direction of interest rates) – so they are demanding an even higher interest rate than they normally would for longer term bonds.

If/when short term rates rise, as is indicated by the “higher than normal” rising yield curve, it means the U.S. Government will pay more for the privilege of borrowing money in the future, and it’s an extra expense we can’t afford.

The historic “weighted average” rate for US government debt is somewhere around 5%, but just as an example, let’s see what happens if we double the rate from the current 2.07% to 4.14%.

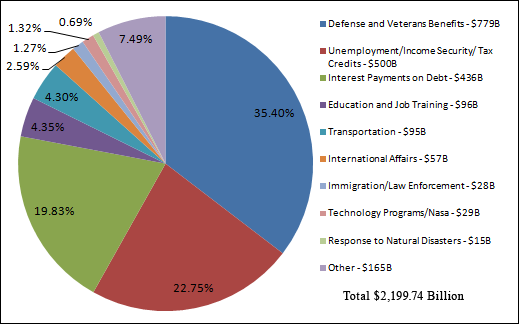

If the average rate that the US Government pays on debt doubles to 4.14%, and nothing else changes, then interest payments also double – from $218 Billion to $436 Billion (since we are currently not paying back any principal with that, it’s all interest).

The total expense budget goes from $1,981.67 Billion to $2,199.74 Billion, and the chart with percentages of each expense category would look like this:

Suddenly, interest payments on the debt goes from 11% to 19.83% of our budget! And without increasing taxes or reducing expenses (since we can’t seem to balance our budget as it is) we would be forced to finance the extra expense, increasing our debt even further (bigger negative amortization). Let’s not forget the fact that we’d also immediately hit our debt ceiling once again, requiring an act of congress to authorize yet another increase.

More debt means more risk to the investors, and more risk means the investors want an even higher interest rate ... and suddenly, we are caught in a very fast downward spiral to bankruptcy.

If interest rates go up, we could go from having a struggling but stable economy, to complete collapse, in a matter of weeks or months. I am not being alarmist – we are walking a very fine line right now.

The Fed is desperately trying to keep interest rates low, purportedly to stimulate the economy – but I think it’s mostly to keep the government’s cash flow afloat.

So what’s the solution?

It should be clear that we are teetering on a tightrope and any change could push us over one side or the other. It doesn’t matter if we go left or go right – either way we fall off the rope.

Reducing spending is an obvious first step, but it means putting people (government employees) out of work – which raises our unemployment burden. Raising taxes is presumed to be a necessary evil, but this also slows the economy: when consumers pay more in taxes, they spend less, resulting in less taxable revenue and higher unemployment as well. Printing more money devalues the dollar and leads to hyper inflation.

There are plenty of proposals flying around, but every one of them gets shot down because of the negative side effects. Anything we do will impact some people more than others and someone will be outraged because it’s “unfair”.

So we’re caught on the tightrope, trying to move forward but not even looking to either side for fear of falling off.

Something needs to be done.

With the caveat that anything we do will be unfair to some portion of the population, and each action we take may have unintended side effects, here is my list of “lowest risk / highest return” steps we should take:

* Cut military spending by at least 50% and deal with the short term unemployment (Seriously! We can do it if we withdraw our troops from the Middle East and Africa, close unnecessary bases, and cancel all the DOD contracts that are bleeding billions into thin air).

* End all farm subsidies.

* Go step by step through every single government agency and eliminate programs that are non-essential.

* Cap interest deductions on home mortgages – keep the interest payment deductible on the first $400K of a home mortgage but eliminate the deduction on the portion of any mortgage above that amount. (And be pro-active about closing loopholes so lenders can’t structure a mortgage with a high interest rate on the first $400K and a low interest rate on the rest.)

* Means test for Social Security and Medicare – phase out eligibility for people with a net worth over $1 million.

* Institute work programs at minimum wage instead of paying unemployment. Even if it’s cleaning streets, you have to work to get paid.

* No public service pension before age 65.

* Eliminate all “double dipping” of pensions for both public and private sector.

* Cap income tax deductions and child tax credits to two dependents – we REALLY need to stop encouraging people to have large families by allowing unlimited dependents. Having more than two children is not only an economic burden on our society, healthcare system, and schools ... it’s also environmentally irresponsible.

* Phase in an additional $3 per gallon gas tax, and put "equivalent" tax on diesel/propane/methane based on BTU’s.

* Eliminate tax exempt status for religious organizations.

* Enact a large “inspection tax” on all incoming sea containers. Large. In addition to the tax revenue, it will help balance the trade deficit and encourage manufacturing at home.

* Abolish the Bush tax cuts.

* Raise retirement age by three years.

* Enact massive tort reform legislation. The overhead of all the ridiculous and unfounded lawsuits is very expensive.

* Implement all the suggestions from my previous post, Tackling The Healthcare Issue.

* Legalize marijuana and tax it.

* Make health insurance deductible for individuals (like it is for corporations) to encourage more people to purchase healthcare rather than be on public assistance.

And finally, when all the above is done ...

* Don’t screw around with the money generated from the above suggestions. Use it to pay off debt.

* Convert 100% of the U.S. National Debt into long term 30 year FULLY AMORTIZED Bonds at as low of an interest rate as possible.

* Make it a national goal to completely eliminate all of our debt in 30 years.

* Make it a national goal to eliminate personal income taxes going forward after that.

* Enact hard and fast legislation that would make it illegal for the federal and state governments to spend beyond their means.

Easy, isn’t it? Ok, no it’s not. Many of these suggestions bother the hell out of me and go against everything I believe in. But if we stop whining about our situation and actually DO SOMETHING productive, we really can eliminate our debt in thirty years. Yes, it will be a painful thirty years – especially the first ten – but every alternative I’ve seen would have far worse consequences than the plan I’ve outlined above.

Addendum:

If you’re a regular reader of my blog, you will know that I have no love for either the Democrats or the Republicans. Both organizations are equally corrupt in my opinion.

Fundamentally, I think that the vast majority of social programs are bunk (with the exception of Social Security, which is actually a successful program but has been horribly mismanaged). And I am a STRONG proponent for lower taxes and fiscal responsibility.

However, “lower taxes” and “fiscal responsibility” are not the same thing. Fiscal responsibility means taking on debt only if the investment you make with that money has a higher return than the interest rate you pay on the debt. It means not taking on any debt without having a plan for how to pay it back. It means knowing what your income and expenses are going to be in the future, and having a plan to stay solvent. It means when you ARE in trouble, finding a way out.

Frankly, I have not seen any more fiscal responsibility in the Republicans than I have in the Democrats. The Republicans changed under Nixon. Milton Friedman promoted the bizarre concept that "deficits don't matter". We went off the gold standard, and both Republicans and Democrats have spent like crazy ever since.

Although Democrat and Republican administrations have spent on different things, neither have had one whit of responsibility about them.

We had the opportunity to eliminate the debt under President Reagan – it was still “manageable” at the time, but instead of taking the more prudent course, we lowered taxes and increased spending dramatically; specifically, military spending went through the roof. It’s not like president Reagan was completely unaware of the issue. Do you remember “The Grace Commission”? Here’s the overview from their report:

In 1982, President Reagan directed the Grace Commission to "work like tireless bloodhounds to root out government inefficiency and waste of tax dollars." For two years, 161 corporate executives and community leaders led an army of 2,000 volunteers on a waste hunt throughout the federal government. Funded entirely by voluntary contributions of $76 million from the private sector, the search cost taxpayers nothing. The Grace Commission made 2,478 recommendations which, if implemented, would save $424.4 billion over three years, an average of $141.5 billion a year – all without eliminating essential services. The 47 volumes and 21,000 pages of the Grace Commission Report constitute a vision of an efficient, well-managed government that is accountable to taxpayers.

This report was very thorough. It won accolades and praise from everyone who read it. Everyone agreed that by following the recommendations from the Grace Commission, the national debt could be paid off by the mid-1990’s and many of the fiscal inefficiencies of running the federal government could be eliminated.

Unfortunately, the report was completely ignored by congress.